Do you know your risks when it comes to business? Two of the biggest mistakes small businesses make are:

- Failing to identify a potential threat.

- Underestimating the severity of a known potential threat.

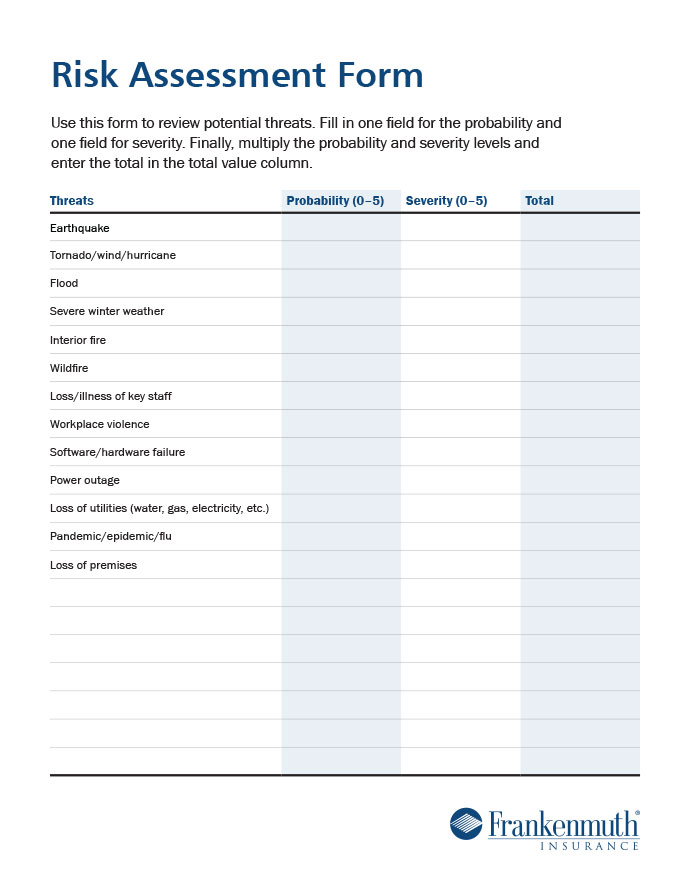

To help you stay ahead of business risks, we recommend performing a risk assessment to help you avoid these mistakes and determine which threats have the greatest potential to disrupt your business. Not sure where to start? Print out this handy risk assessment form and follow along as we walk you through common threats.

How to complete the risk assessment.

Step #1: Identify your threats. Weather, technology, employees — what threats are most likely to affect your business? Add any threats you are exposed to that are not already listed.

• Don’t forget to consider damage to infrastructure, like roads, bridges, power lines, etc. that could affect your ability to resume operations. Develop possible workarounds to expedite recovery.

• Contact your local emergency management office to obtain a copy of your community’s hazard vulnerability analysis, which will list the possible natural and man-made hazards that could affect your area.

Step #2: Rank the probability of threats. How likely is this threat to happen? Assign a rank of 0 (not likely) to 5 (very likely) in the “probability” column.

Step #3: Rank the severity of threats. Assess the amount of damage the event can cause. To do this, think about the duration, magnitude, and extent of the potential threat’s reach. For example, would the damage reach just one floor of your building, the entire structure, the whole neighborhood, or the entire region? After assessing these factors, assign a rank of 0 to 5 (low to high severity) in the “severity” column.

Step #4: Multiply the probability and severity scores for each threat. After ranking the probability and severity for each threat, multiply the two values and record the answer in the “total” column. The threats with the highest total values, 17-25, are those you need to plan for as soon as possible. Assume these hazards will strike your business at some time, then determine what controls you have in place or could implement to minimize your risks.

Step #5: Talk to your local, independent agent. With this deep thought and new knowledge about your business risks, it’s time to talk to your local, independent agent. They will review your risks with you, ask questions, look at your existing policies, and potentially recommend additional coverages to strengthen your insurance protection. They may even suggest having a safety services expert visit your workplace to further identify threats and reduce exposures.

Because the best businesses are prepared for the worst, we also offer a comprehensive Disaster Preparedness Guide. Use it to know your risks, build a recovery plan, and successfully implement safety standards.

This content was developed for general informational purposes only. While we strive to keep the information relevant and up to date, we make no guarantees or warranties regarding the completeness, accuracy, or reliability of the information, products, services, or graphics contained within the blog. The blog content is not intended to serve as professional or expert advice for your insurance needs. Contact your local, independent insurance agent for coverage advice and policy services.